Things I Have Learnt About Spending Money

Saving money is easy. Anyone can teach that. Spend less than you make and you’ll be left with something, that’s savings for you. Spending money can never be easy though. Not only you start thinking about letting go of your hard earned money, you also question the value of your expenditure.

A dinner in a five star hotel once a month. Is it worth it you may ask especially when the food and the experience is heavenly. There is no right or wrong answer. The only thing which is certain is that you may regret spending less money on your death bed.

Spending enough does not mean you do not think about your personal finances or your future. It’s all about striking the right balance and prioritising what matters.

“Money is so complicated. There’s a human element that can defy logic – it’s personal, it’s messy, it’s emotional.”

How to decide how much to spend and what’s worth spending on?

I personally use two frameworks to decide what’s worth my money. The first is ladder of freedom and the second is the utility of spending.

In the first framework - the ladder of spending money, the decisions are based on net-worth. Remember, no matter how much you earn, if you do not have assets, then everything is meaningless. Without assets, you’re a donkey running on a treadmill to earn your daily bread. So step 1 is to ensure that you are focused on accumulating assets and increasing your net worth. However, when you climb through the ladders, the first few steps on the ladder have to be supported by your active income before your assets start playing a larger role.

First Level of Freedom

At this first level, the idea is to be free from thinking about the daily expenses like buying groceries, paying for local transport, or the daily coffee at your favourite coffee shop. At this level, you will continue to earn your daily living but have enough assets that will continue to grow for you through returns and additional contributions. A good level of net-worth to start considering yourself free would be from INR 10 lakhs or a little more than $10,000. Just ensure that your expenses also cover your health and life insurance requirements.

Second Level of Freedom

At this level of freedom, the idea is to have enough wealth to be able to pay for convenience and comfort. For example, being able to take cabs even at surge prices, eating at your preferred restaurants, or hiring a house help. Again, at this level, it is your income that should support these expenses. Net-worth only acts as a decision making tool. I believe that the second level freedom comes at net-worths above INR 75-80 lakhs or $100,000.

Third Level of Freedom

Here, the expenses of level 1 and 2 are least of our worries. You take a step up in the convenience game where a couple of nights at a five star hotel or an expensive emergency flight tickets are quite affordable. This probably starts beyond net-worths of INR 5 crores in my opinion. I use the 0.1% rule here. Would my net-worth allow me to spend INR 50 thousand at a hotel without loss of sleep. If I can say Hell yes, I go for it.

Final level - The financial freedom level

You have accumulated enough to say FU to your bosses. You have enough money to live your life comfortably, travel, eat good food, and enjoy life. This number is different for everyone since the discretionary spends are completely different. Hence a million dollars may be enough for you and 5 million may be enough for me.

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

Some sources to read more about the ladders of wealth and financial freedom -

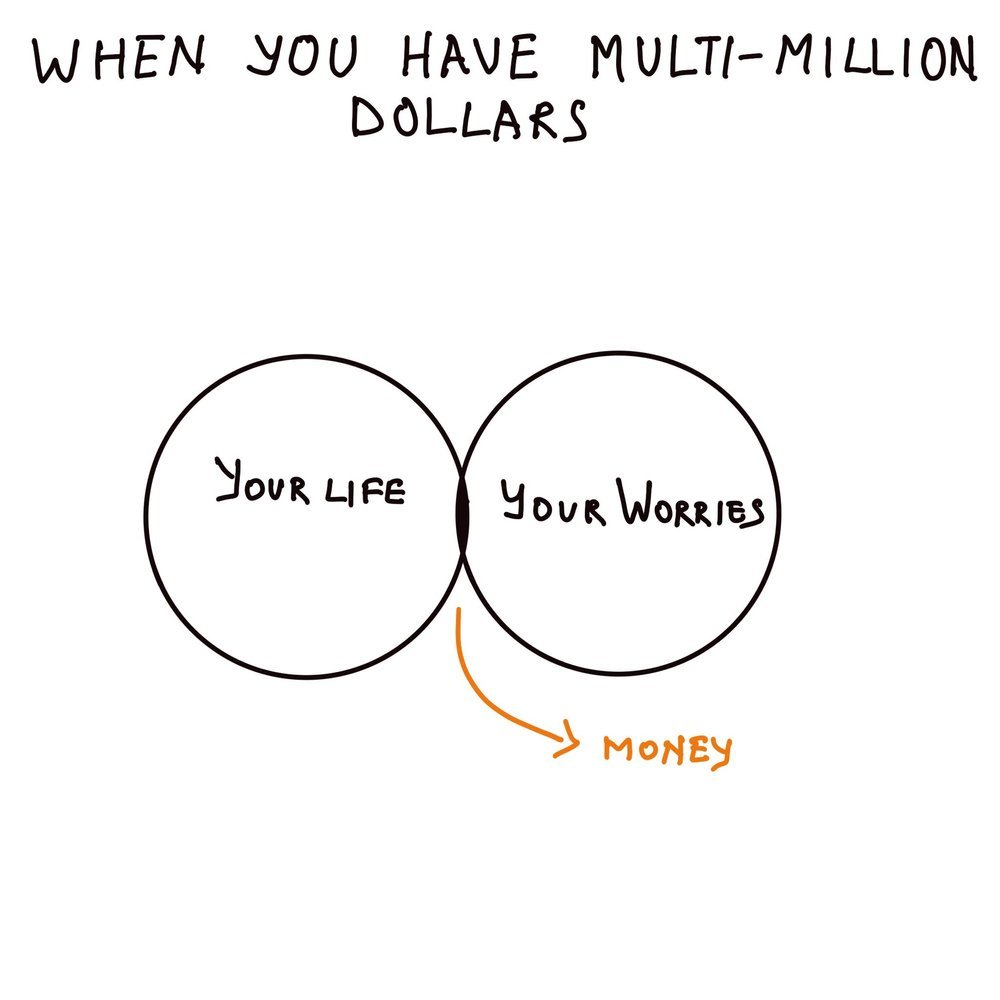

“Money is like sex. When you have NONE, you can hardly think of anything else. When you have PLENTY, you think of other things.”

Utility of Spending Money

There is another way of looking at how to spend money. It is through the perceived utility. As your net-worth continues to go up, you probably should spend your money to make your life better each day. Here is a broad framework that I use -

Buy Durable Things

I spend money on things that last long very long. For example, I recently bought Birkenstock slippers that cost INR 10,000. My wife and friends have been using it for years. Highly durable and good for my feet. Another example is the wallet from slim fold. This one costs approximately INR 4,500 but I have been using it for 6 years now. Our fridge is 16 years old now.

Buy The Best Stuff that you use everyday

An office chair or a mattress are some things that we use every day. Paying a high price for good products is probably better for you since it improves your health and probably increases your lifespan as well. Good footwear is another example.

Do Not Spend A Bomb On Things That Need To Be Changed Frequently

Clothes are the best example here. Even though I don’t compromise on quality since it is in direct touch with my body, finding cheap and good quality clothes is not that hard.

Spend Money To Create Experiences

I lost my father early so I know the important of spending time with family. Create as many memories you can. We try to do 2-4 holidays every year. We go out to eat frequently. Once you have enough, do not think too much about spending in this category.

Never Compromise on Things That Can Prevent The Risk of Death

Think about the things you do every day where there is a risk of death. Commute is what probably comes to mind. We recently bought a car with 5 star N-cap rating and six airbags. It did cost a bomb but at least I know that my family and I are safe.

Prepare for the worst, buy insurance

The best way to protect the family from any calamity is covering everyone with insurance. Buy a term insurance, health insurance, accident insurance, and critical illness cover. I am yet to add the last two covers.

Value Your Time - Outsource

Your time is the most valuable resource. If you can, outsource most of it. Cooking, cleaning, maintenance, taxes, everything is outsource for us.